rsu tax rate us

Pay next years state income tax and property tax this year to reduce this years income tax 4. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

The timing of RSU tax is exactly the same as any other.

. The beauty of RSUs is in the simplicity of the way they get taxed. RSUs are not taxable when they are granted. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance.

For a NRA the taxable event will require withholding at source when you exercise the RSU when the income is distributed to you. The total is 108000 and each increment is taxable on its vesting date as compensation income when the shares. Generally there is no tax upon the sale of shares if the shareholder together with their fiscal partner has an interest less than 5 percent in the nominal subscribed share capital determined per class of shares.

The companies many a times sell certain portion of such shares after vesting to pay the tax on such vesting. Employers will usually deal with this under PAYE and so if you are the recipient of some RSUs initially there is nothing you need to do to make that happen. Ad Compare Your 2022 Tax Bracket vs.

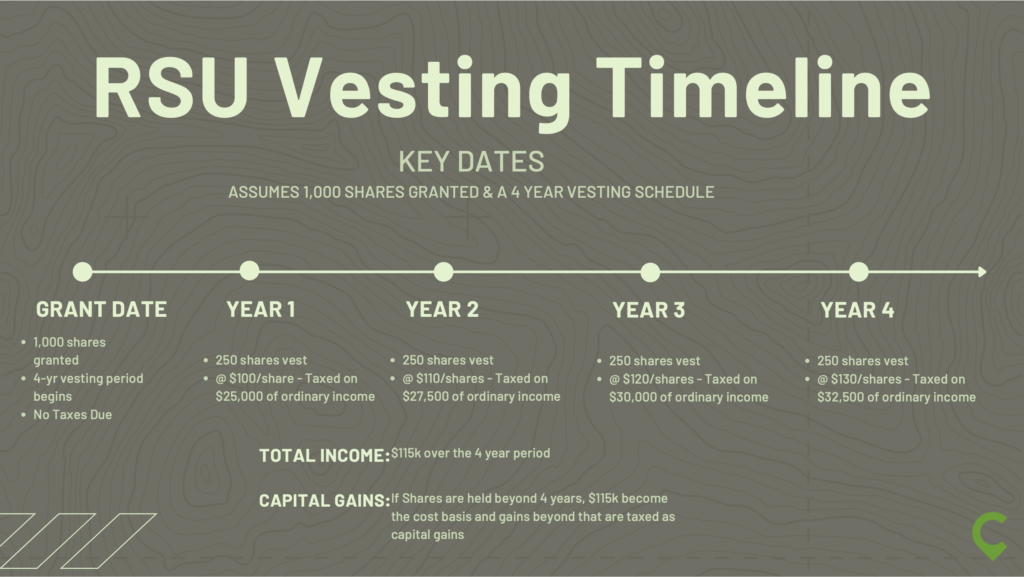

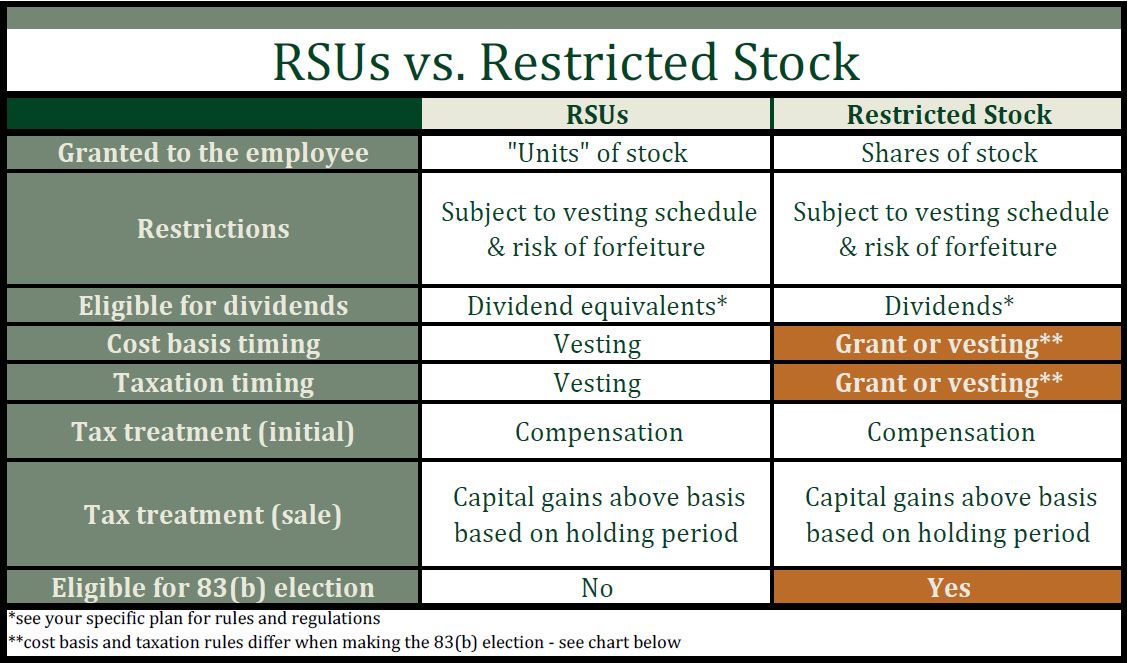

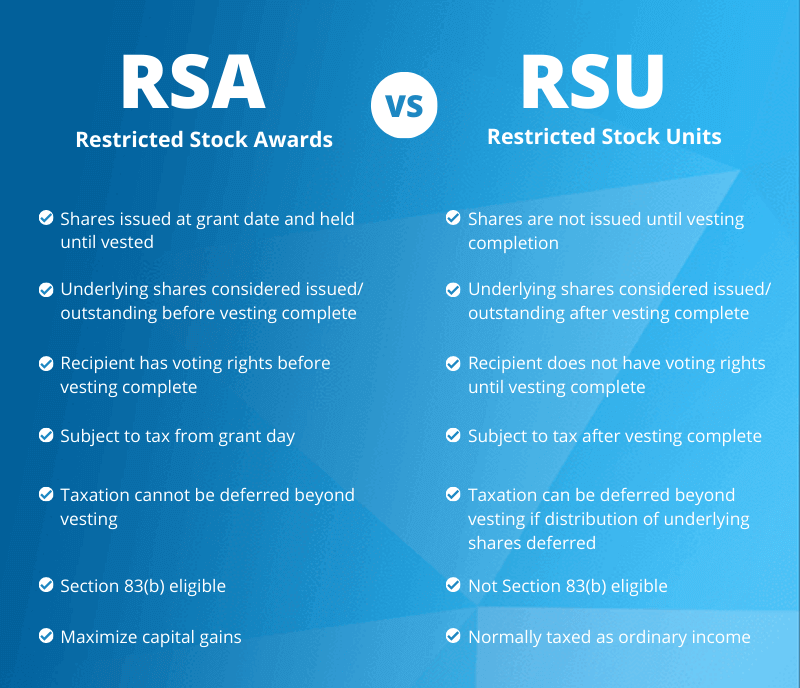

Restricted stock is a stock typically given to an executive of a company. Rsu tax rate us Sunday March 6 2022 Edit Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option. Vesting Schedule Hypothetical Future Value Per Share.

When the RSU vest with the employee he need to include it in his salary income as perquisite and pay tax on same. The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. The RSUs you get will be taxed about half de to it being income and when you sell capital gains whether you sell form the US or Canada. Marginal Federal Tax Rate You can use the 2020 brackets below to.

For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift. Donating RSU vested shares vs. The stock is restricted because it is subject to certain conditions.

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Discover Helpful Information and Resources on Taxes From AARP. Enter the amount of your new grant - whether an offer grant or an annual refresh.

Your 2021 Tax Bracket to See Whats Been Adjusted. With that understanding we can now move on to the year-end tax strategies for RSUs which are. 514-393-6507 Amélie Desrochers Tel.

Decide on your strategy. Long-term capital gains are taxed at a special lower rate. The stock price at vesting in year one is 20 1000 x 20 20000 of ordinary income at year two 25 25000 at year three 30 30000 and at year four 33 33000.

You receive 4000 RSUs that vest at a rate of 25 a year and the market price at grant is 18. 23 days ago. This happens over time through a vesting schedule.

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Basic Info for RSU Calculator. Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts.

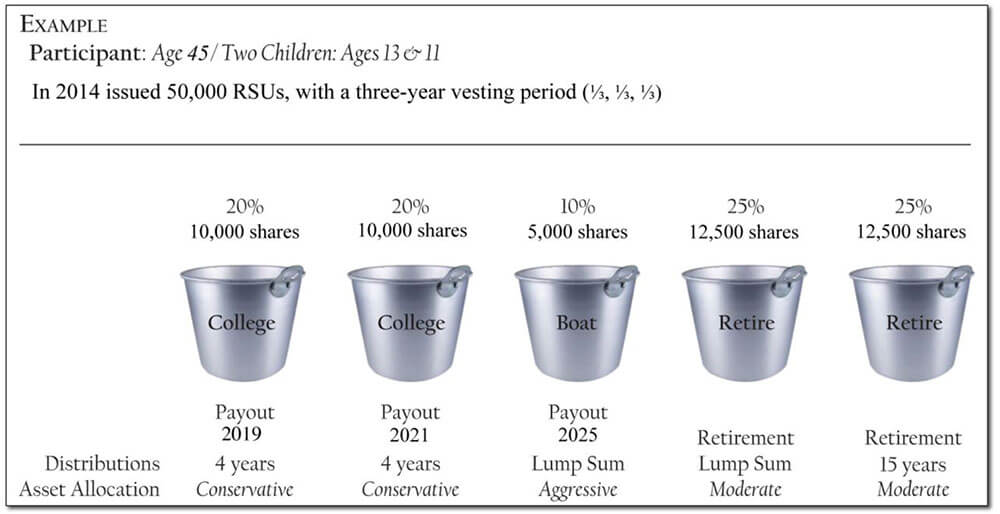

Deferring income around RSU Income 2. 520 Broadway Floor 7 New York. For most people the tax rate on long-term capital gains is 15.

If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate. You have the potential to exercise at a much lower tax rate because the 409A valuation may be equal to or close to the strike price. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

Companies issue various forms of equity compensation including restricted stock units RSUs incentive stock options ISOs and non-qualified options NQOs. Some states have capital gains tax as well. 157 How Restricted Stocks and RSUs Are Taxed.

At the time of vesting. 1 At the time of vesting and 2 At the time of sale. Op 23 days ago.

Here is an article on employee stock options. Unlike the much more complicated ESPP they get taxed the same way as your income. The beauty of RSUs is in the simplicity of the way they get taxed.

613-751-6674 Chantal Baril Tel. There is normally a 30 withholding required but a treaty Article if there is a treaty between the US and the country of the NRA that could be lower. Thus the RSU above attracts tax two times.

If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. Restricted Stock Units RSUs Tax Calculator. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent.

Input your current marginal tax rate on vesting RSUs. 514-393-5554 The Canada Revenue Agency CRA has issued new commentary 1 with respect to taxation of restricted stock units RSUs. Unless specific facts and.

Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting schedule. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

To use the RSU projection calculator walk through the following steps. Estimate how much your RSU value will increase per year. For high earners the capital gains tax rate is anywhere from 188 to 238.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. As a CDN tax resindet you will always be taxed with CDN tax rates.

RSUs can also be subject to capital. This article will examine the nature of restricted stock and restricted stock units RSUs and how they are taxed. Selling RSU vested shares this year to avoid the Medicare Surtax next year 3.

How Are Restricted Stock Units RSUs Taxed.

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsa Vs Rsu All You Need To Know Eqvista

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc